Highlights

Table of Contents

Explore article topics

Tel Aviv and NYC, June 29 — Artlist announced today it has raised $48M in financing led by a leading global investment firm, KKR. Existing investor Elephant Partners, who led a previously unannounced investment in 2018, also joined in the round.

Artlist will use the investment to increase the company’s value to its users by rapidly expanding its existing content catalogs as well as adding new features and assets on their way to becoming more of a complete solution for the growing number of YouTubers and other content creators.

Serving the growing needs of content creators

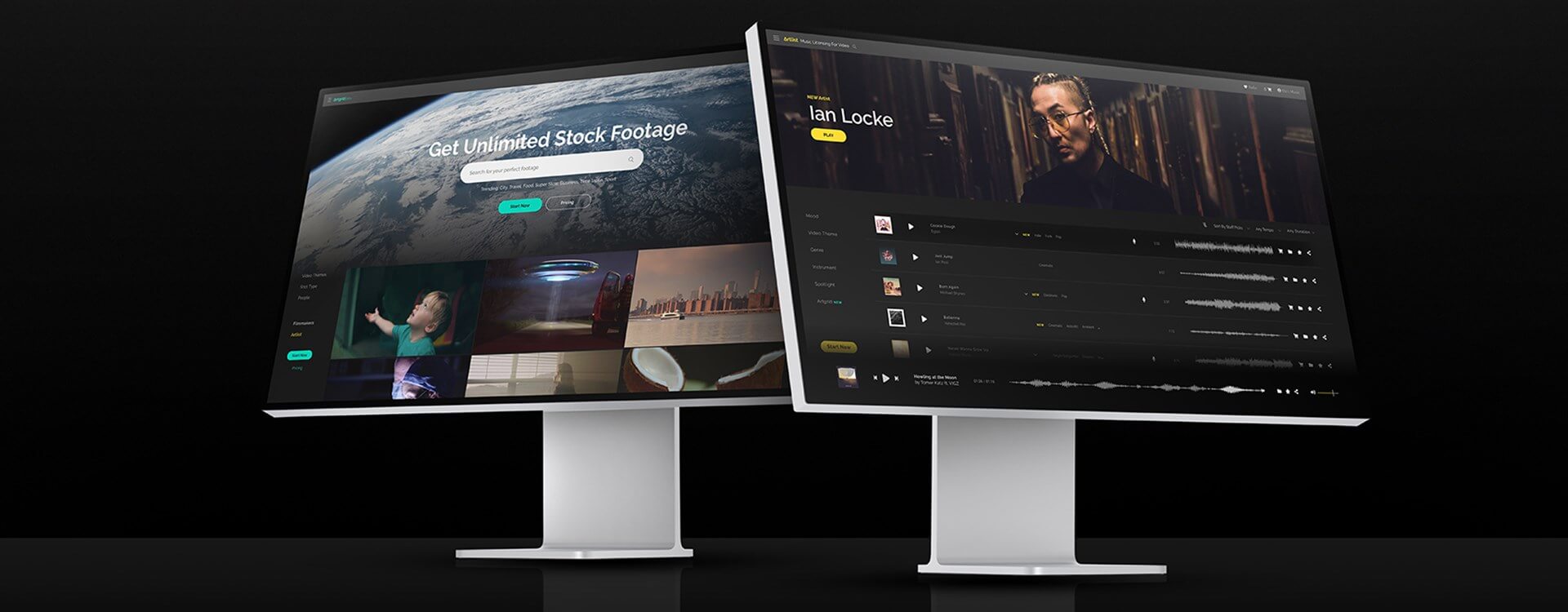

Founded in 2016 as a music licensing platform, Artlist has since broadened its capabilities by launching the site Artgrid in April 2019 and by adding a sound effects library earlier this year. All Artlist products offer the same universal license – covering projects that feature music downloaded with a paid subscription forever, so creators stop worrying about copyright issues.

With the new investment, Artlist is poised to serve the growing number of digital content creators producing an increasing amount of content. It is estimated that the average person will spend 100 minutes every day watching online videos in 2021, an increase of about 20% compared to daily viewing minutes in 2019.

“This investment allows us to accelerate growth and product development and quickly add new content that is aimed to be the top tier of digital stock in the world,” said Ira Belsky, Artlist co-CEO and co-founder. The company will also look to expand into new adjacent branches both organically and via acquisitions. “We want to cater to all content creators with every type of digital asset they might need.”

Get unlimited royalty-free sound effects

KKR’s investment in Artlist comes primarily from its Next Generation Technology Growth Fund II. “We are excited to welcome KKR as a new investor and look forward to working alongside their team that brings decades of experience building leading global companies. KKR’s tech and media expertise, networks and relevant prior investments such as Fotolia and BMG Rights Management provide added value,” said Artlist co-founder and co-CEO Itzik Elbaz.

Supporting a Community of Artists

Patrick Devine, a member of KKR’s Next Generation Technology Growth investment team, said, “The growth of digital content creation – and the evolving way in which it is consumed – has generated a tremendous amount of opportunities for creators, but the process of licensing digital assets remains a significant challenge for small and large creators alike. What impresses us most about Artlist is the management team’s dedication to helping creators focus on what they do best and removing friction from the process of discovering and accessing content.”

Over the past year, YouTubers have become the company’s fastest-growing segment, with Artlist and Artgrid now being used by over 1 million content creators as well as top brands. The company also recently added Mike Weissman, President of music service company SoundCloud, as a board director. “Artlist is one of the most impressive creative technology businesses that I’ve come across, led by a strong team that cares deeply about supporting their community of filmmakers, video professionals, musicians and other creative professionals,” he said. “I am excited and honored to join them alongside KKR and Elephant to help them grow and scale the company.”

Being a meeting point between musicians and video creators, Artlist enables sustainable income for thousands of professional contributors who produce original royalty-free music, original stock footage, and sound effects downloaded by over 1 million users, and who otherwise would not be able to monetize their work at any meaningful scale. The top Artlist contributors earn hundreds of thousands of dollars.

About KKR

KKR is a leading global investment firm that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate and credit, with strategic partners that manage hedge funds. The firm aims to generate attractive investment returns for its fund investors by following a patient and disciplined investment approach, employing world-class people, and driving growth and value creation with KKR portfolio companies. KKR invests its own capital alongside the capital it manages for fund investors and provides financing solutions and investment opportunities through its capital markets business. References to KKR’s investments may include the activities of its sponsored funds. For additional information about KKR & Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com and on Twitter @KKR_Co.

About Elephant Partners

Elephant Partners is a venture capital firm focused on enterprise software, consumer internet and mobile markets. The firm was founded in 2015 with offices in Boston and New York.

Share this article

Did you find this article useful?

Related Posts

- By Artlist

- 4 MIN READ

Latest Posts

- 25 Apr

- By Josh Edwards

- 4 MIN READ